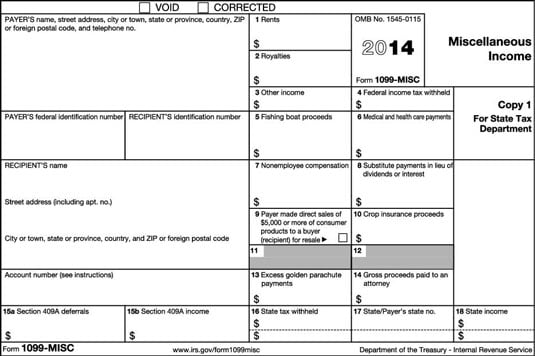

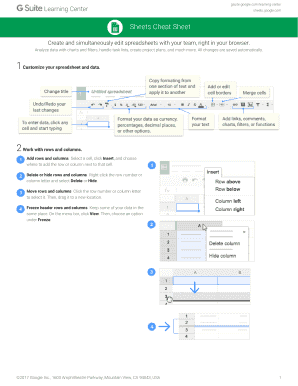

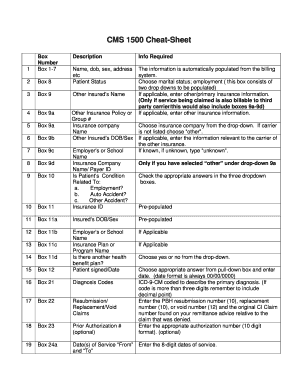

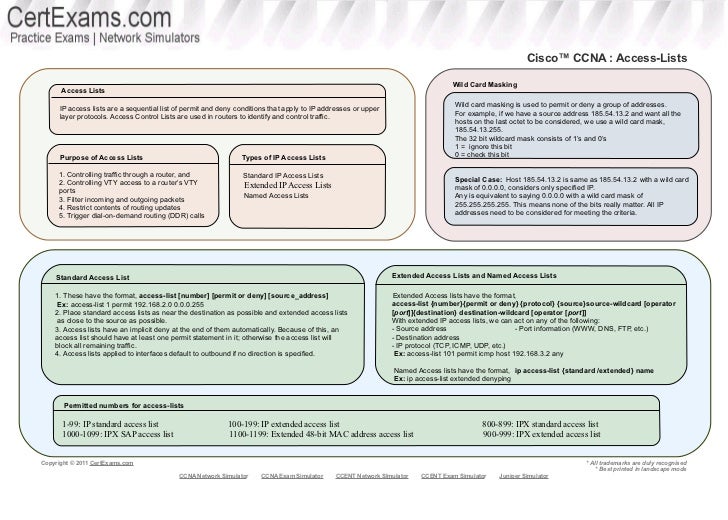

Forms W2, W4, W9, and 1099 Cheat sheet!1 A NixOS cheat sheet and comparison to Ubuntu 11 Comparison of secret managing schemes;Form 1099INT Interest Income Schedule B – Part I X "B" Form 1099K Merchant Card & ThirdParty Payments 1099K Worksheet "99K" Form 1099Misc Miscellaneous Income 1099MISC Worksheet X "99M"

P Property Management Property Management 1099 Cheat Sheet Management Miami

1099 cheat sheet for keeping up with taxes

1099 cheat sheet for keeping up with taxes-Ysoserial JexBoss JNDI/LDAP When we control an address for lookup of JNDILearn how with my 1099 cheat sheet

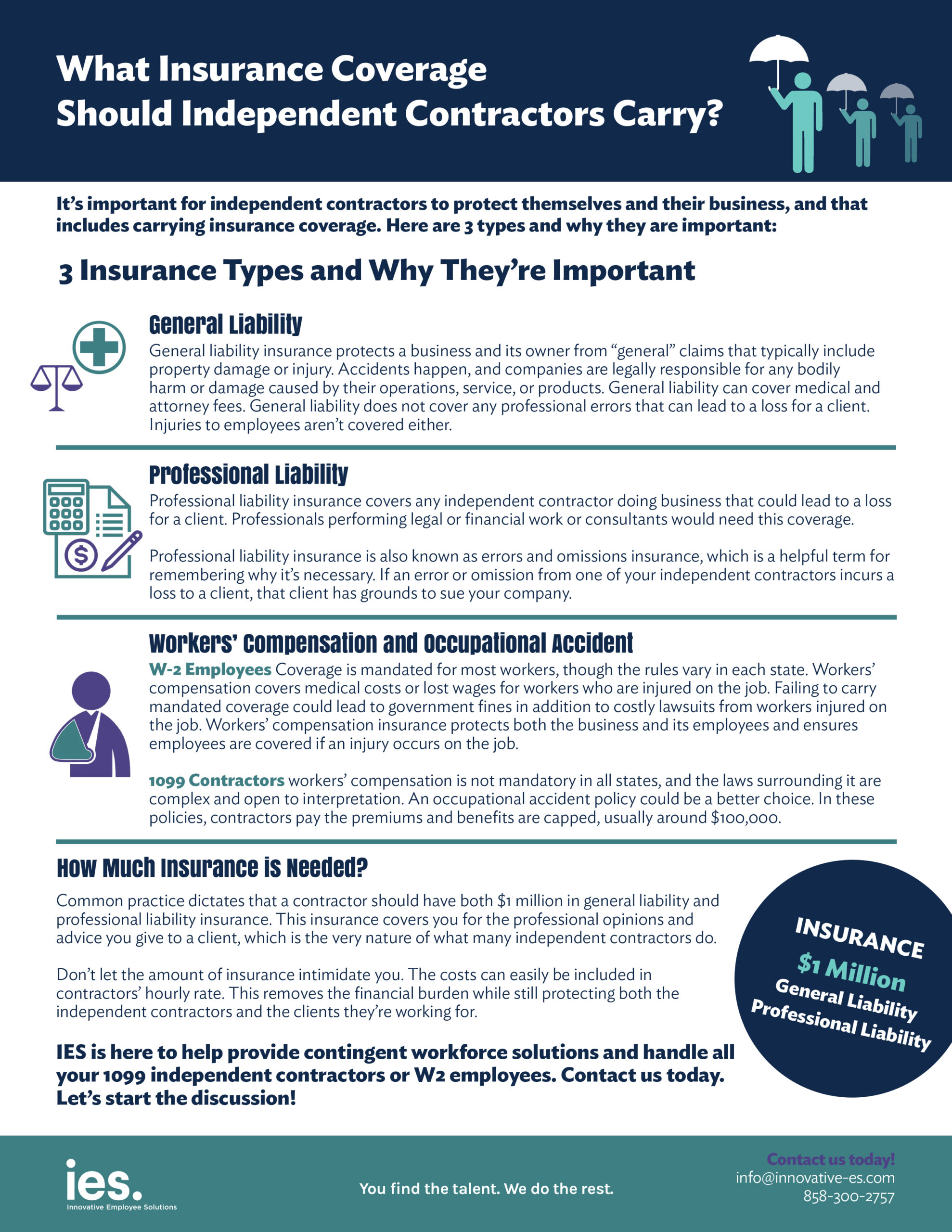

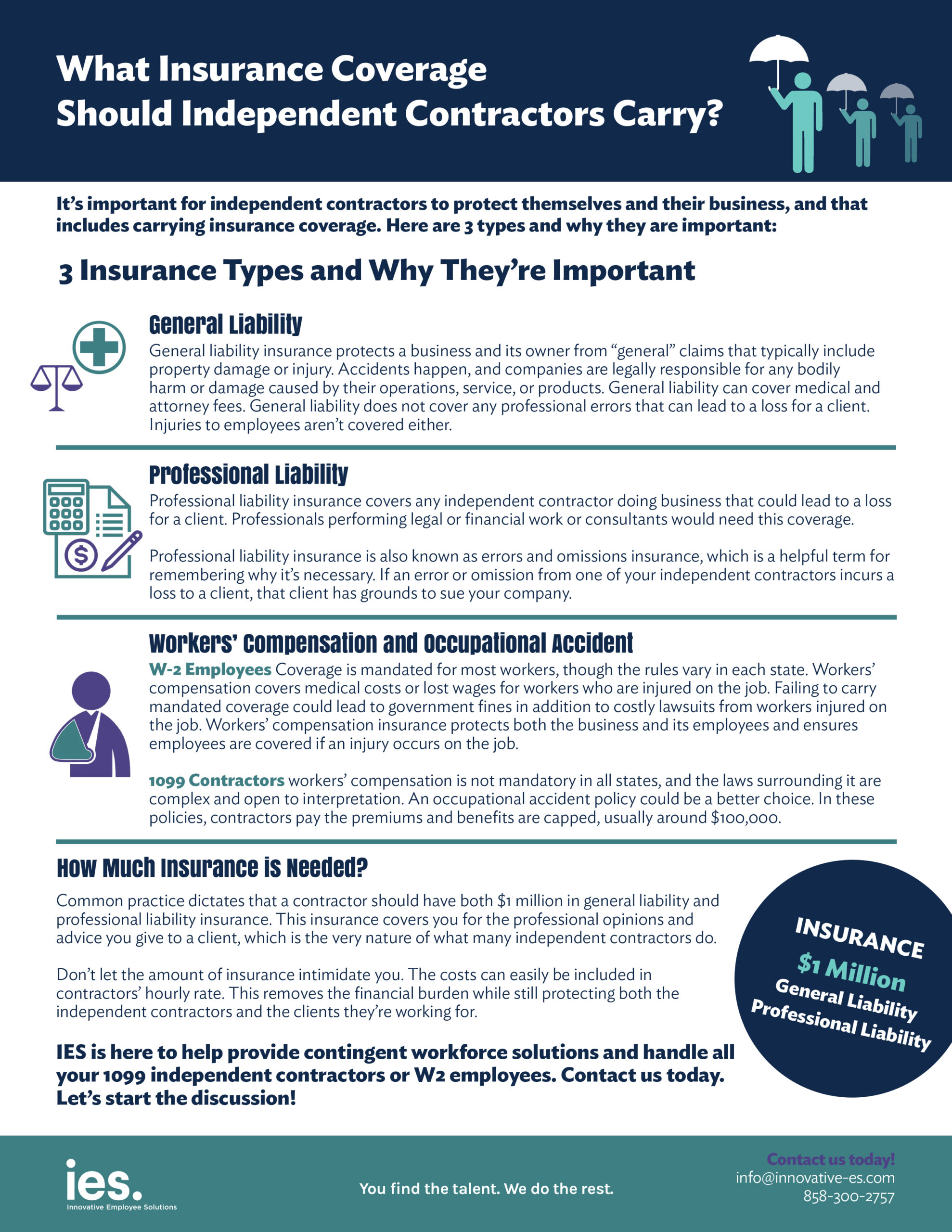

What Insurance Coverage Should Independent Contractors Carry

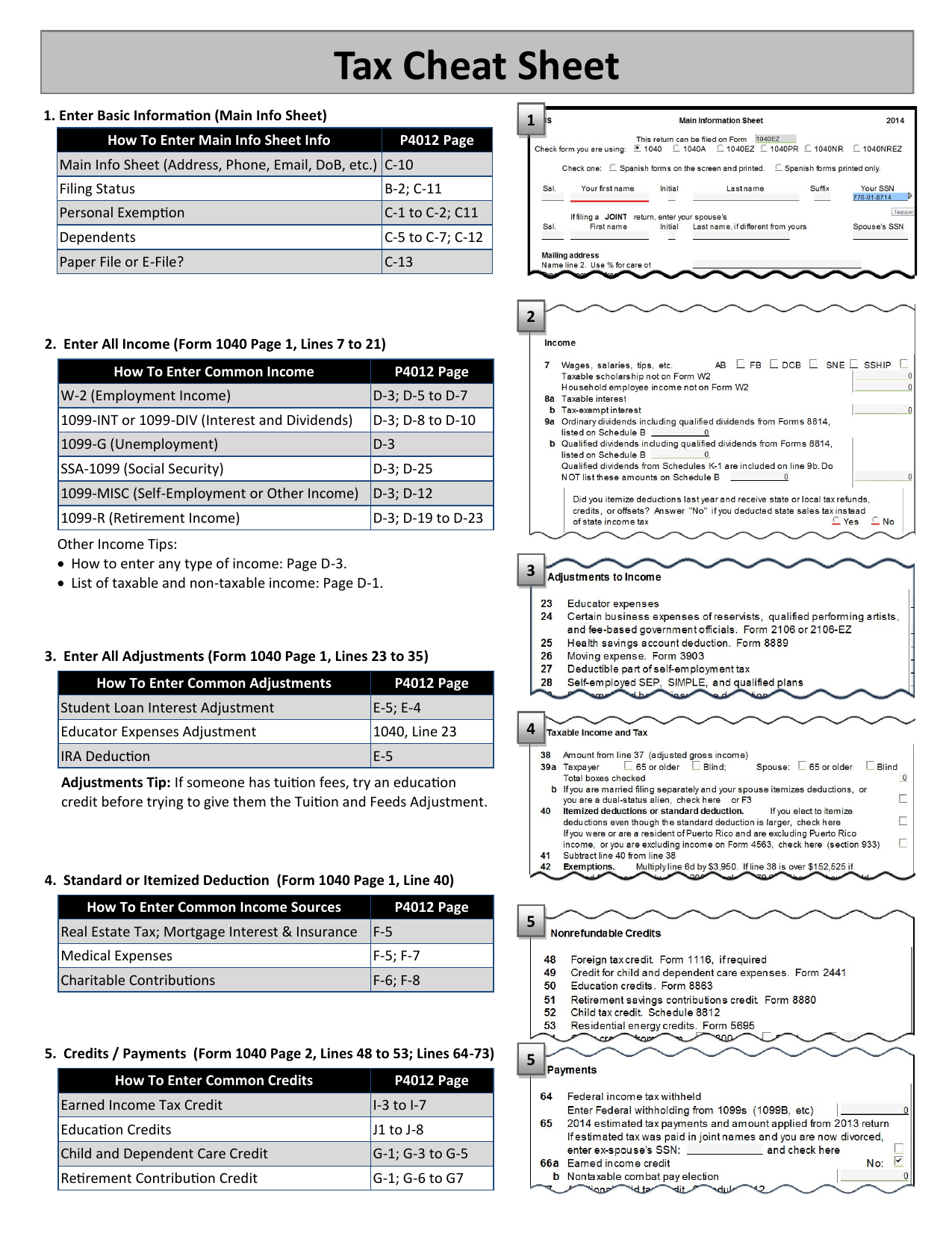

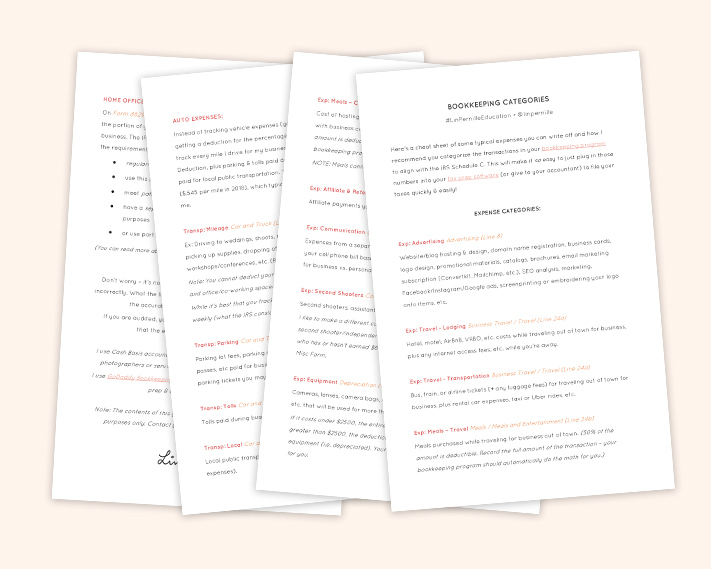

6Step Cheat Sheet for LastMinute Filing by Susannah McQuitty You got this—all you have to do is start! A few things about this cheat sheet first, you might not have deductions in every single category Businesses vary based on industry and every industry has it's own expenses I still recommend you read through the whole cheat sheet you never know what you might be missing!24 Manually switching a NixOS system to a certain version of system closure

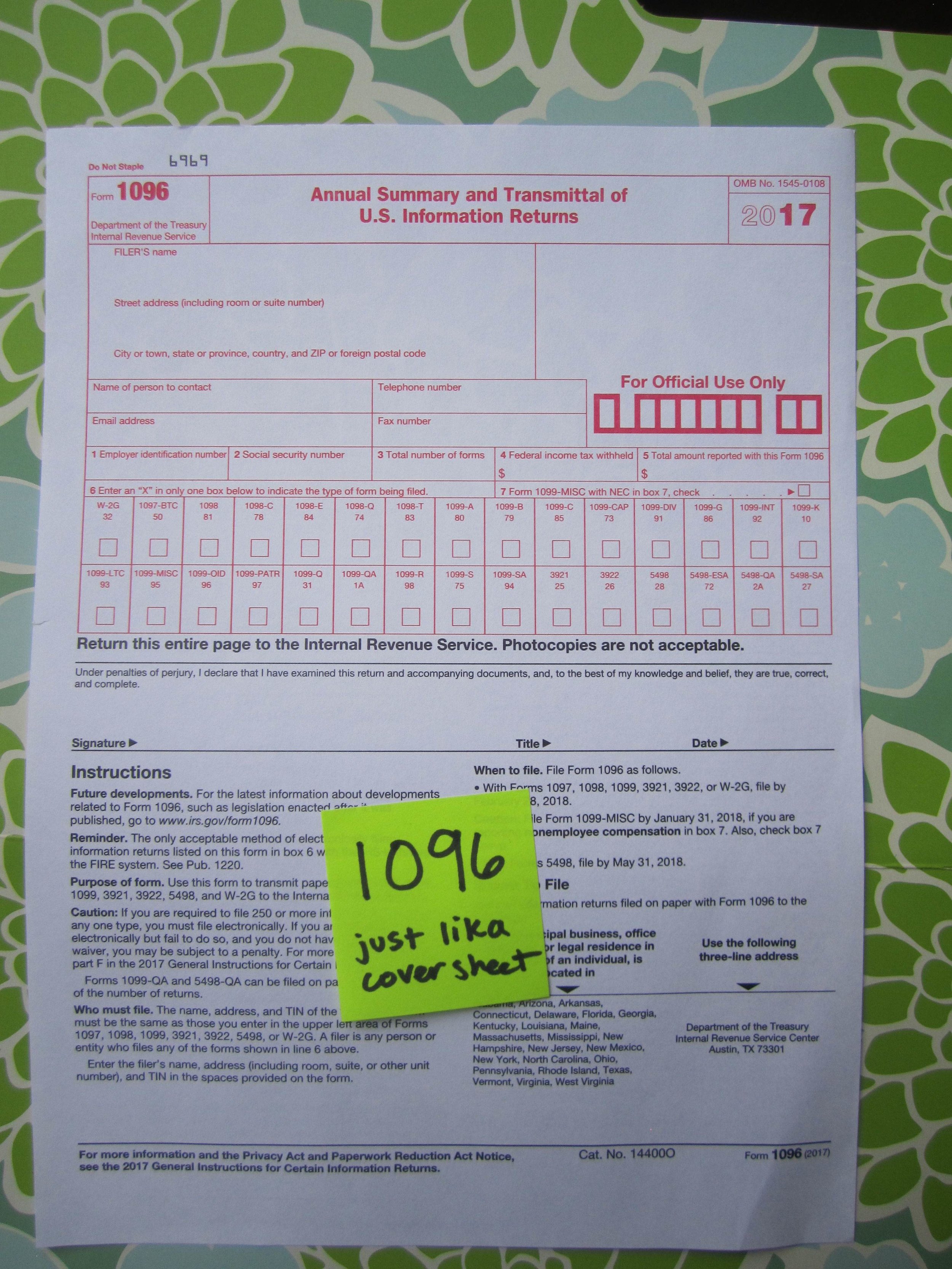

Free 1099 Success Cheat Sheet Want to be ready for 1099s at year end?Samantha Wolf, CPA swolf@stephanoslackcomCategories 1099 s 1096 10, Massachusetts 1099K Reporting, Massachusetts 1099K Reporting Requirements 18 Tax Cut Cheat Sheet for Employers The United States Congress passed the Tax Cuts and Jobs Act of 17 on

Print the decision matrix chart included with this cheat sheet so you'll never again have to wonder if a vendor will need to "be 1099'd" at yearend The number one question to ask yourself is if you bought goods or services from the vendor 1099 forms only report the payment of services So whether you bought o!ce supplies or airplanes, vendors who sold you a physical product do notThis week on The Financial Safari, Coach Pete D'Arruda is joined by Gregg Berrian, Chuck Kaiton and Thomas Lipscomb discuss the "Traffic Light Theory", a 1099 Cheat Sheet, Forever Tax vs Never Tax, the GPI Plan, Brokers Behaving Badly, Coach Goes McEnroe, a look back at 1965 with Morgan Patrick1099 Essentials Starts With The W9 Payee Refuses to Provide a TIN ;

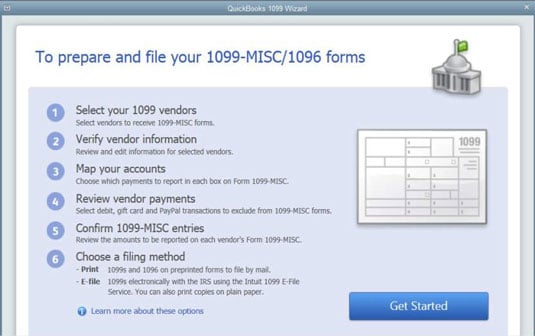

Producing 1099s For Vendors And Contractors Dummies

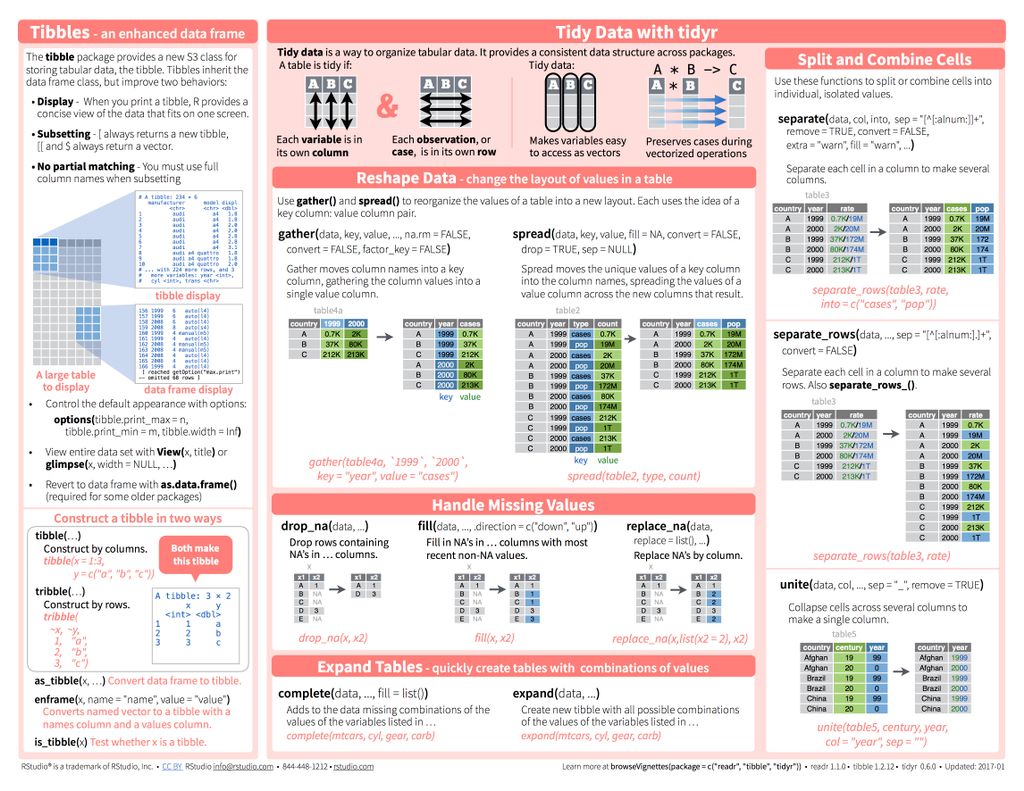

Mara Averick Woah Cheat Sheet Mania New Rstudio Data Import Cheat Sheet Wrangling Updated Too T Co 1yntp9mtsp Rstats T Co 2dyqyxsdz1

If you are planning on taking on your 1099 preparation yourself – contact Samantha Wolf at swolf@stephanoslackcom for a onepage cheat sheet!Get Your Free 'Cheat Sheet' to Quickly Know the Ordinances in Your State Save time and frustration!Second, some of the categories overlap You may think, "Huh but that one sounds like one I

9 Frequently Asked Questions 1099 S Sage Intacct Blog Cla Cliftonlarsonallen

9 Frequently Asked Questions 1099 S Sage Intacct Blog Cla Cliftonlarsonallen

Ysoserial (works only against a RMI registry service) JMX Protocol based on RMI;The Payroll Mate team put together this "cheat sheet" that covers some of the common questions employers have about the new bill When will the IRS publish the 18 withholding tables? The 1099MISC isn't just for contractors if you've paid anyone more than $600 for a service (or rent) in the course of the year—think your landlord or your lawyer—you'll give them one too The IRS website has a full list of anyone who might need to receive a 1099MISC Each of these vendors and contractors will need your Taxpayer Identification Number and Certification to

Fast Answers About 1099 Forms For Independent Workers 1099 Tax Form Fillable Forms W2 Forms

What Is Irs Form 1099 Misc Miscellaneous Income Nerdwallet

LINEHAUL TRUCKING 1099 – MISC Bring in ALL 1099s received FUEL SURCHARGE Do your records agree YES with the amount reported?Nury Gomez, MBA Follow Independent Business Owner atAlles, was du dazu wissen musst, auf einem Cheat Sheet!

Grad Student Tax Lie 2 You Received A 1099 Misc You Are Self Employed Personal Finance For Phds

Doordash 1099 Taxes And Write Offs Stride Blog

Property Management 1099 Cheat Sheet J RevillaAlbo Even though the IRS has a thorough set of instructions available for 1099 processing, manypeople still find themselves unsure of who should receive a 1099 and what the minimum amount is Others are unclear about when they need to mail the 1099's by, or when they need to be filed with the IRSThis week on The Financial Safari, Coach Pete D'Arruda is joined by Gregg Berrian, Chuck Kaiton and Thomas Lipscomb discuss the "Traffic Light Theory", a 1099 Cheat Sheet, Forever Tax vs Never Tax, the GPI Plan, Brokers Behaving Badly, Coach Goes McEnroe, a look back at 1965 with Morgan Patrick and a lot more!Data Validation Basics US Persons ;

Do You Need To Issue A 1099 To Your Vendors Accountingprose

How To Crack The 1099 Misc Code Avoid Penalties With These Tips

A cheat sheet for pentesters and researchers about deserialization vulnerabilities in various Java (JVM) serialization libraries Please, Default 1099/tcp for rmiregistry;QuickBooks Time signin Sign in to your Intuit account to access all our products, including QuickBooks Time Learn more Security code Sign in with Google or Company Phone number, email or user ID Standard call, message, or data rates may apply Email or User ID Phone1099NEC Reporting Starts With The W9 Name and TIN "Cheat Sheet" Cont'd ;

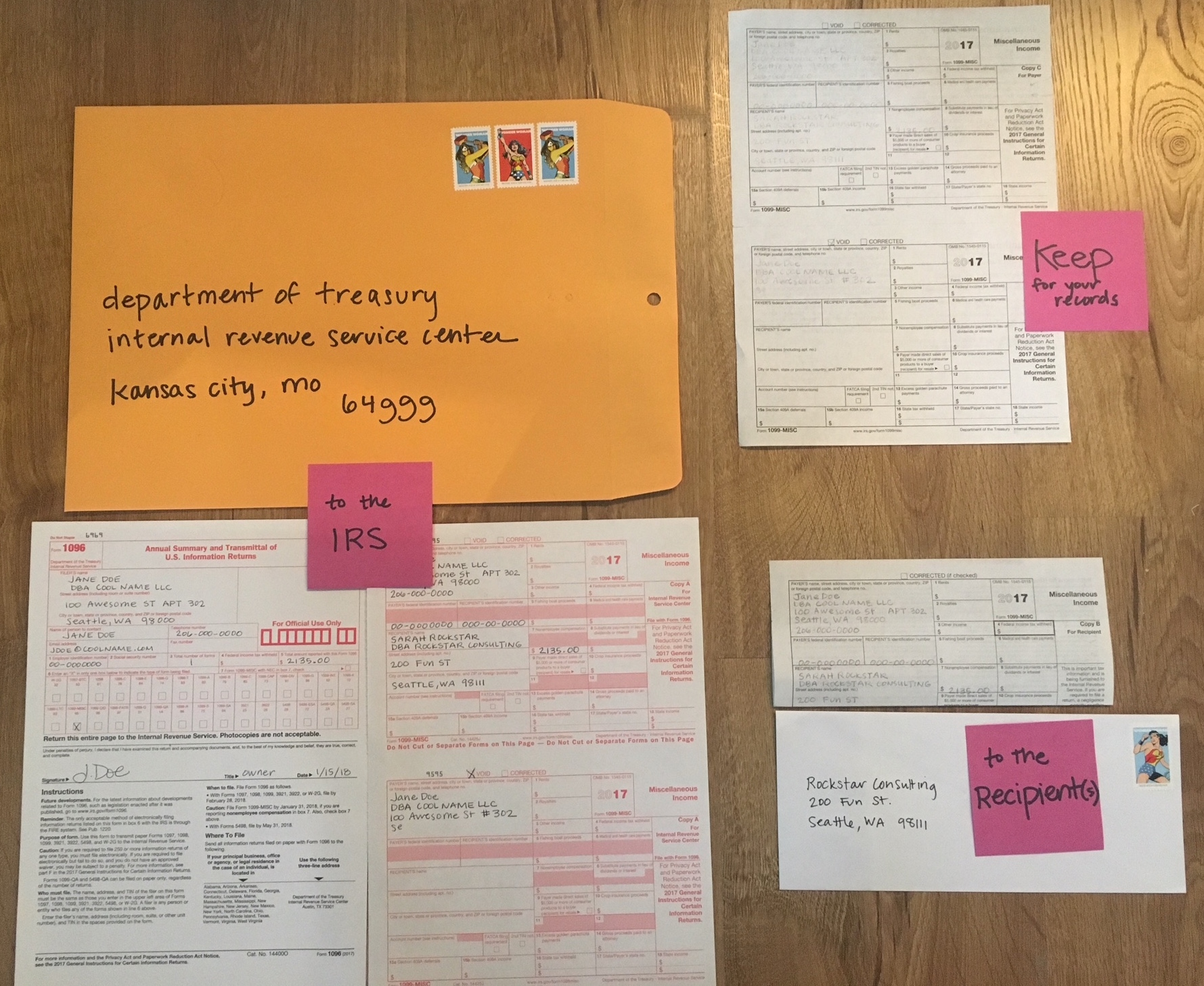

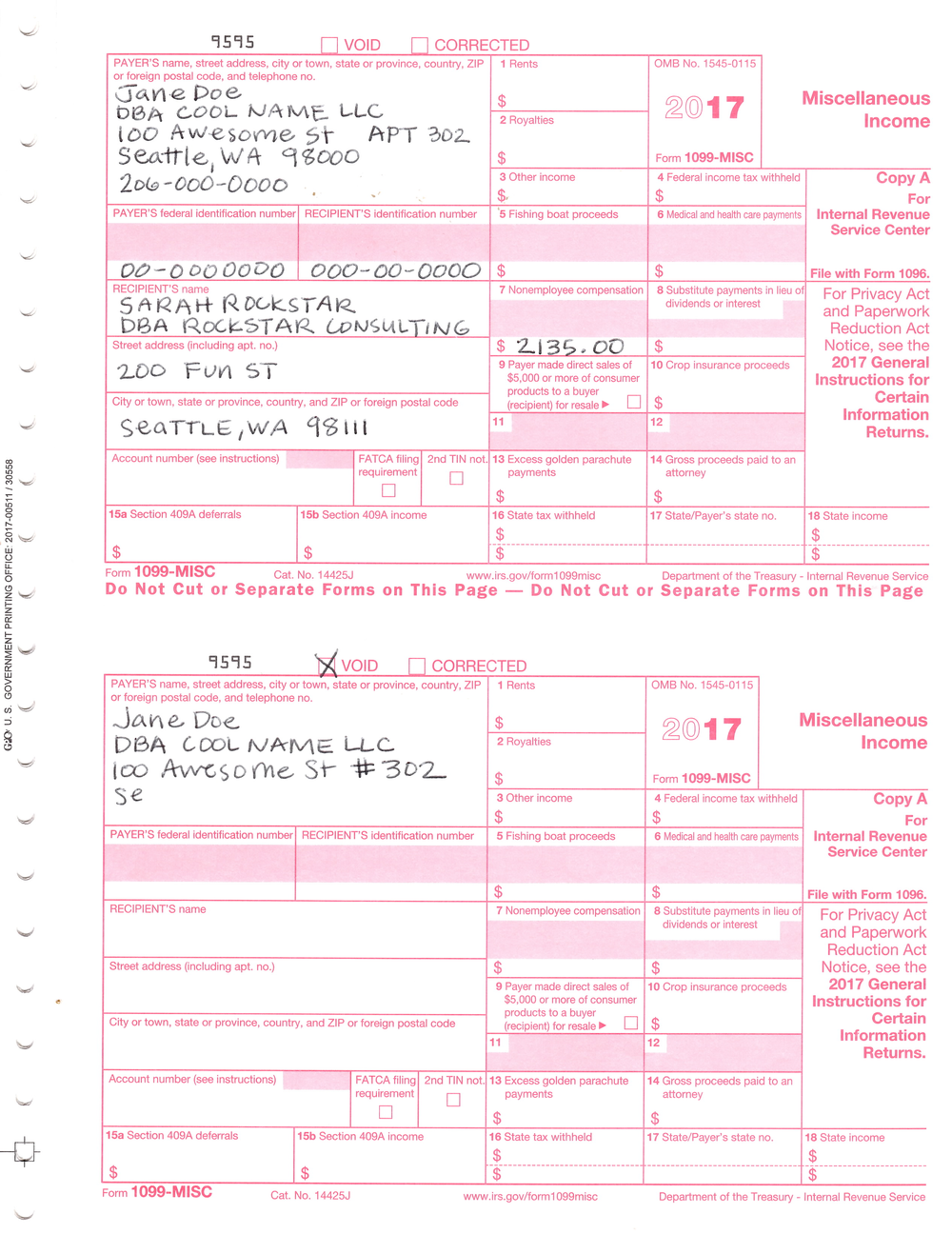

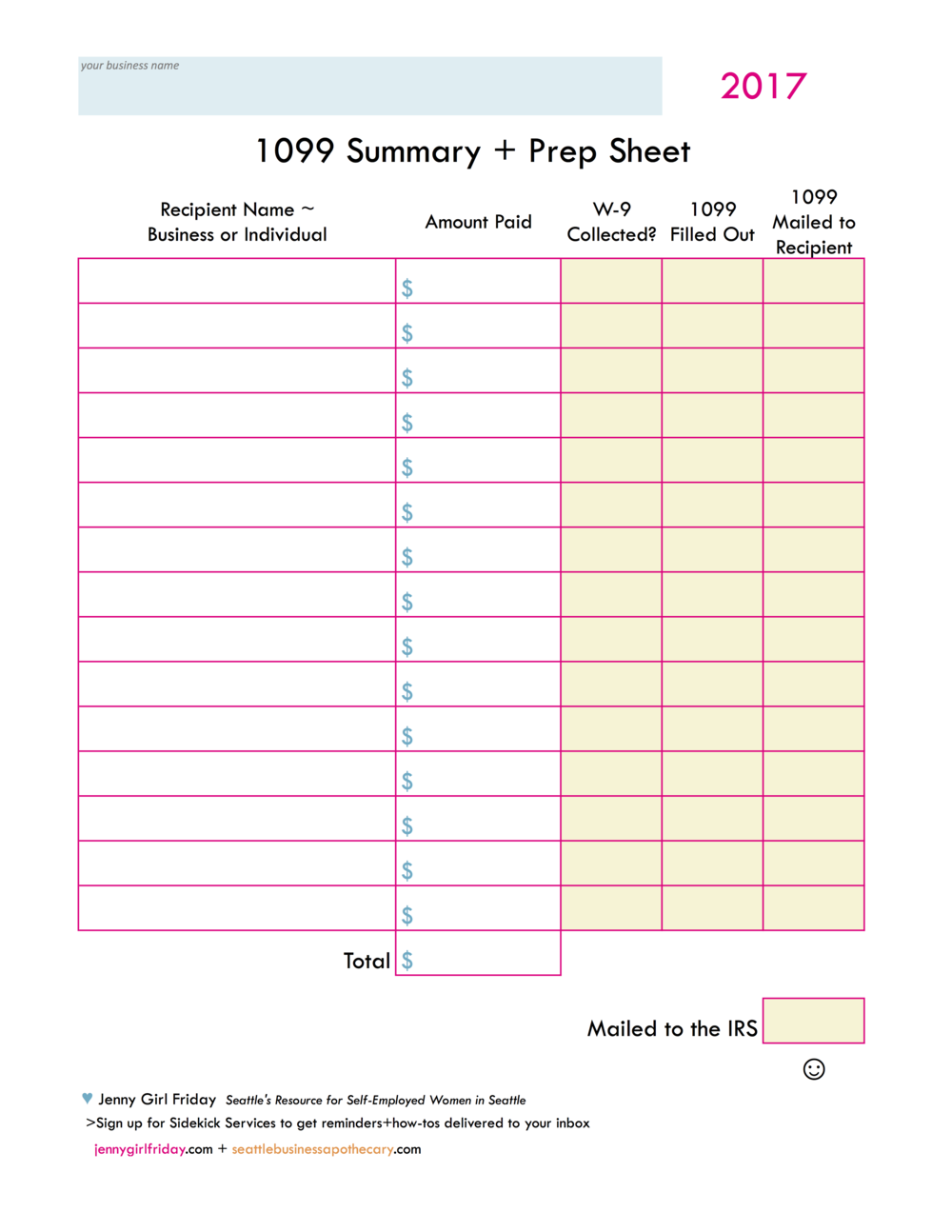

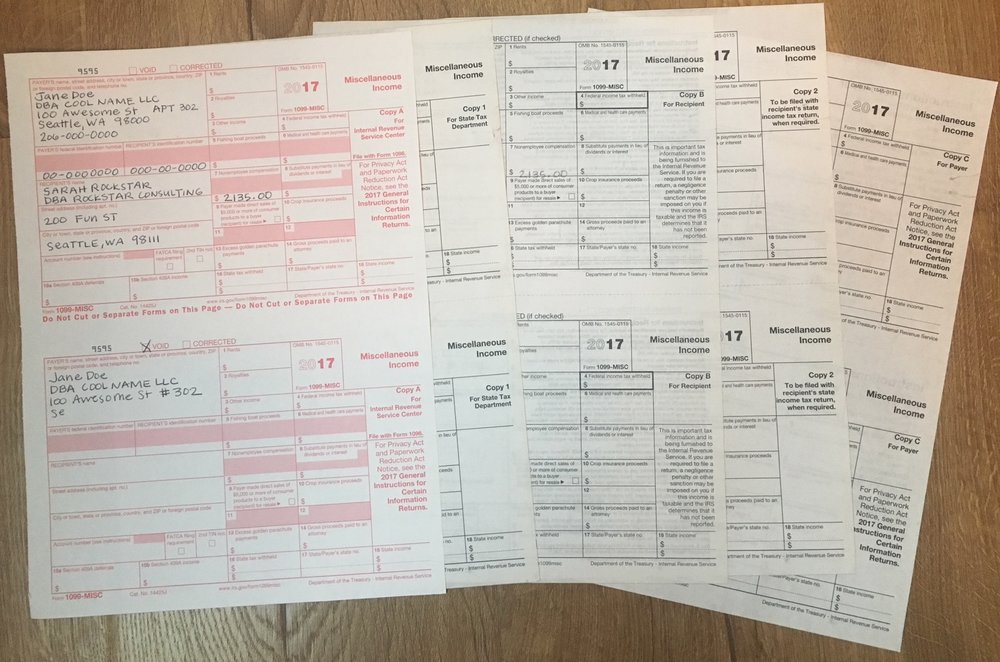

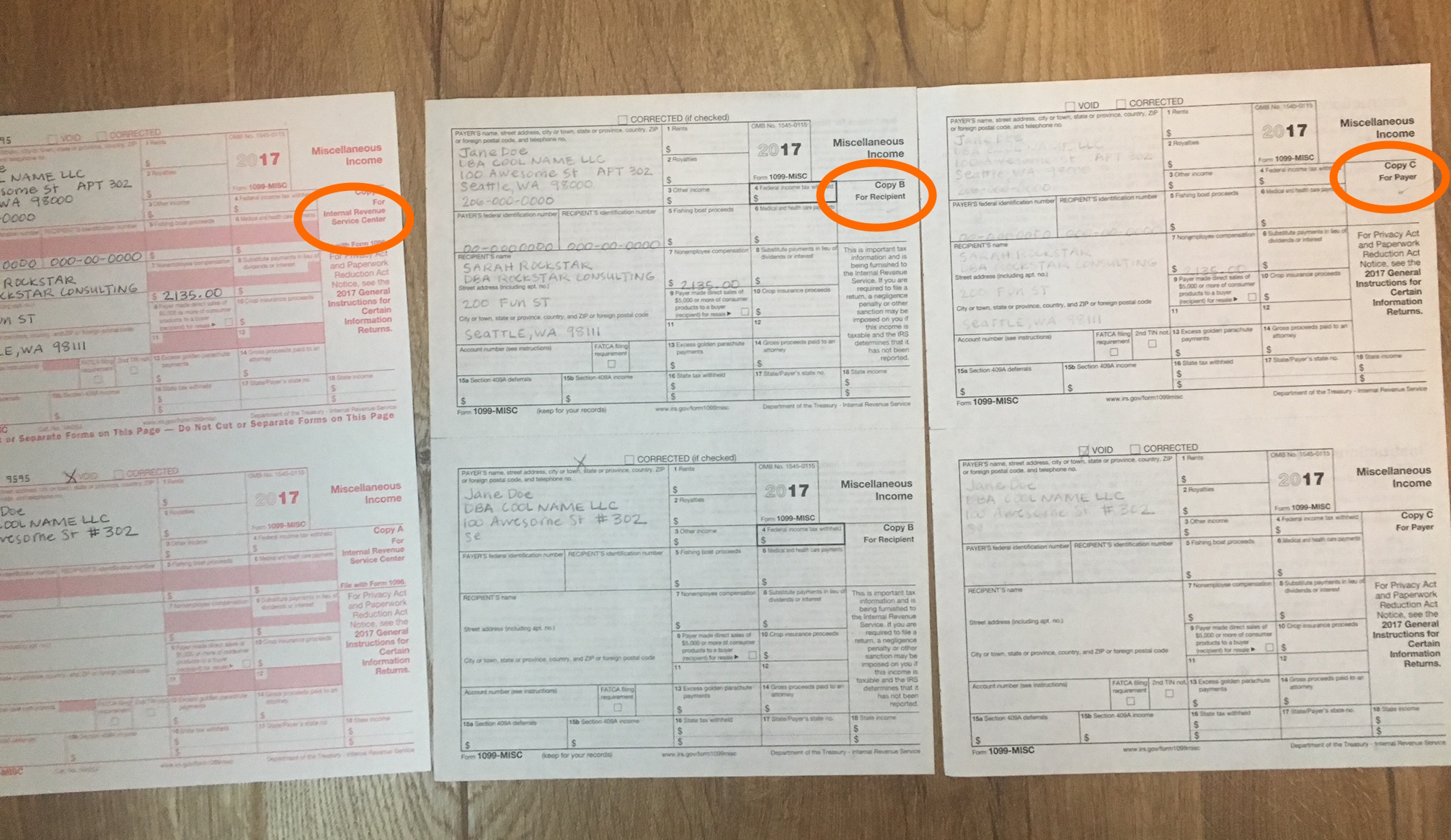

How To Fill Out Send 1099 Misc Forms Seattle Business Apothecary Resource Center For Self Employed Women

Pure Powershell Infosec Cheatsheet Infosecmatter

Always Validate Claims of Who needs to get a 1099 at the end of the year? Here's a cheat sheet to help you navigate the most popular tax forms Latest Stock Picks Investing Basics Form 1099MISC, Miscellaneous Income If you were paid $600 or

What Insurance Coverage Should Independent Contractors Carry

Tax Deduction Recorder 175 Pkg Item 01 700

Learn how with my 1099 cheat sheet1099NEC Reporting Starts With The W9 Payee Refuses to Provide a TIN ;We make filing taxes delightfully simple with one, flat–rate price Every feature included for everyone Start filing Most Popular Articles 4 Summer Activities That Could Affect Your Taxes tax tips 3 Reasons You Might Want to Opt Out of Advance

Your Ultimate Guide To 1099s

Do You Find Yourself Drowning In Paperwork And Documents It S Hard To Know What To Keep And What To Thro Credit Card Statement Paper Organization Paper Trail

Currently, the federal minimum wage is $725 States and cities around the country are passing their own minimum wageTesting Heuristics Cheat Sheet Testing Wisdom A test is an experiment designed to reveal information or answer a specific question about the software or system * Stakeholders have questions; Accounting and Taxes A Freelance Blogger's Cheat Sheet So you decided to become a freelance blogger You know your topic and you're well versed in WordPress You think you're all set However, as you're filling out your personal tax forms –it's that time of year!– you think "Oh wow, I'm going to have to keep track of the money coming in and out and fill out tax

Understanding Your Tax Forms 16 1099 Misc Miscellaneous Income Tax Forms Printable Job Applications Important Life Lessons

How To Fill Out Send 1099 Misc Forms Seattle Business Apothecary Resource Center For Self Employed Women

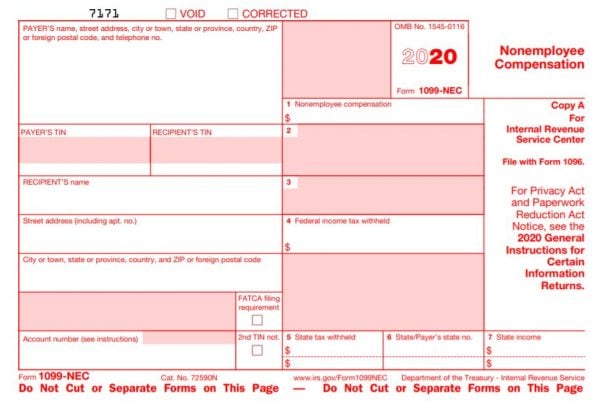

Markdown Guide The Markdown Guide is a free and opensource reference guide that explains how to use Markdown, the simple and easytouse markup language you can use to format virtually any document Get Started DigitalOcean Managed MongoDB, a fully managed DBaaS for modern apps Try now with $100 credit Ad by EthicalAdsPartially patched in JRE;Taxpayers who receive a 1099MISC but believe they are employees Starting in , nonemployee compensation is reported on Form 1099NEC, but prior to amounts reported in 1099MISC Box 7 are for nonemployee compensation The taxpayer received 1099MISC instead of Form W2 because the payer did not consider them an employee and thus did not withhold

Clearlawinstitute Com Ce Webinars The 1099 W 9 Annual Update Course 8 Cli The 1099 W 9 Annual Update Course 9

Www Ubs Com Content Dam Static Wmamericas Irsform1099 Reporting Pdf

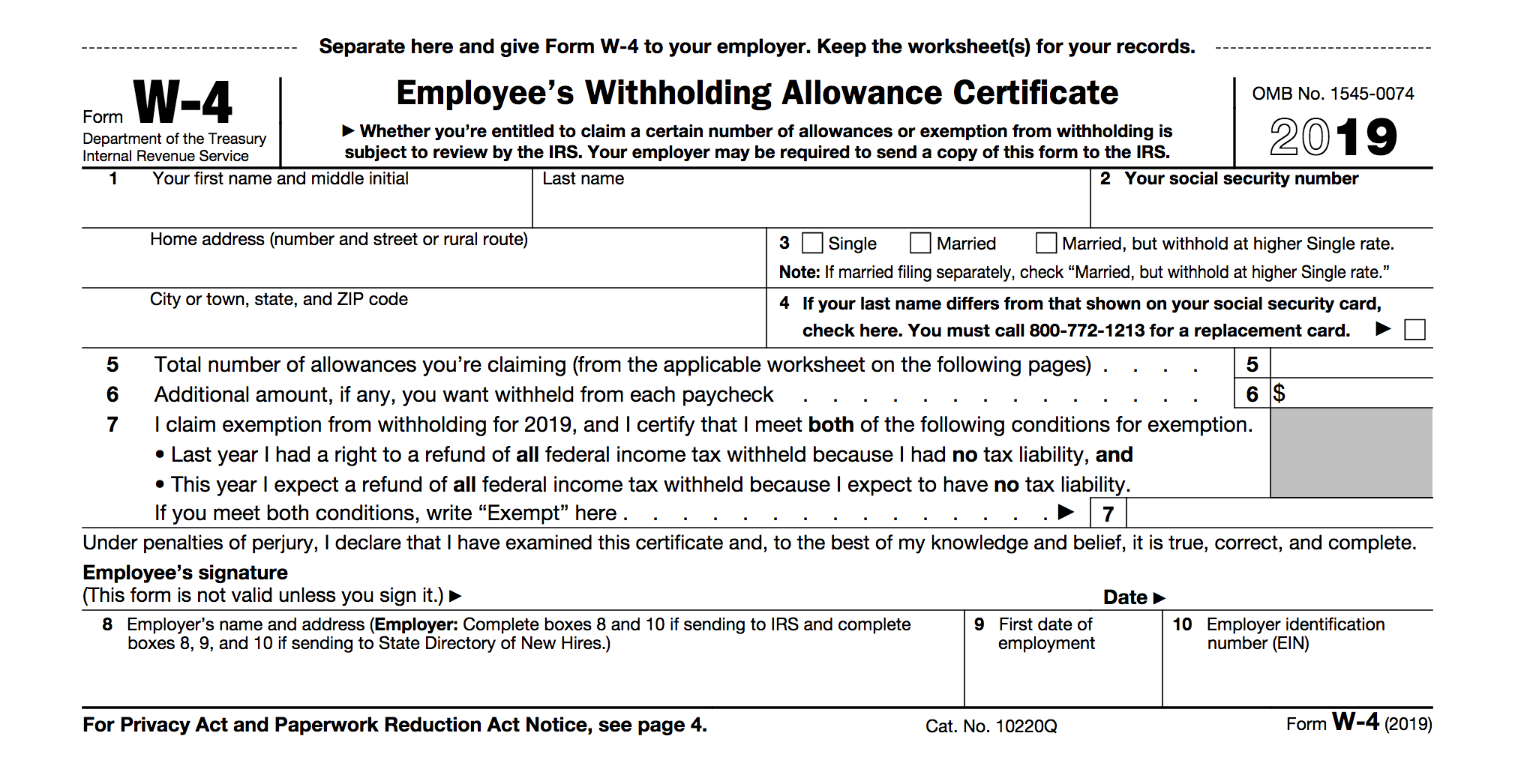

Testers have answers * Don't confuse speed with progress * Take a contrary approach * Observation is exploratoryNO PICKUP AND DELIVERY Did you receive $10, in actual cash from any TRUCK RENTAL FEES individual at any one time—or in accumulated amounts—during this tax year?Form W4 (19) Future developments For the latest information about any future developments related to Form W4, such as legislation enacted after it was published, go to

Http Public Titlecorenational Com Web images Intranet 1099 Pdf

The Ultimate List Of Tax Deductions For Online Sellers In Gusto

Data Validation Basics Identifying Your Payee ; Updated Minimum Wage Cheat Sheet Is keeping up with changes to the Minimum Wage rates making your head spin?Form 1099MISC for services performed by an independent contractor (defned as a "serviceprovider") must report A servicerecipient means any individual, person, corporation, association, or partnership, or agent thereof, doing business in California, deriving trade or business income from sources within this state, or in any manner in the course of trade or business subject to the

Tax Cheat Sheet Free Tax Campaign

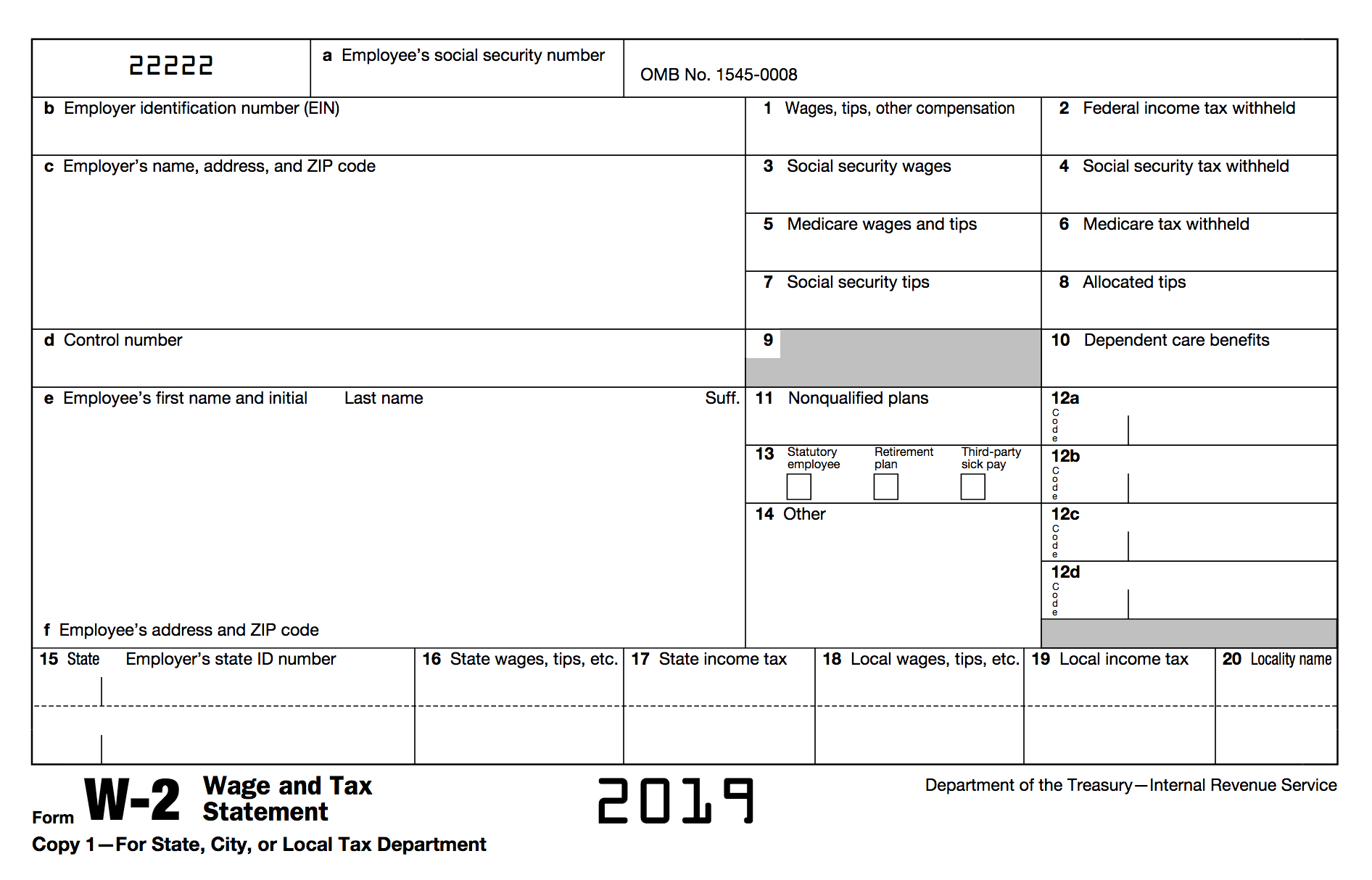

W 2 And W 4 A Simple Breakdown Bench Accounting

Get Your Free 'Cheat Sheet' to Quickly Know the Requirements in Your State Save time and frustration!In a statement on , the IRS said they will be publishing Notice 1036 (Early Release Copies of the Percentage Method Tables for Income Tax Withholding) in January 181099 Essentials Starts With The W9 Name and TIn "Cheat Sheet" (Cont'd) ;

Tuition And Fees Deduction

The Epic Cheat Sheet To Deductions For Self Employed Rockstars

If you would like Stephano Slack to handle your 1099 preparation, please contact Samantha Wolf no later than December 1 st, 17!2 Working with the nix store 21 Get the store path for a package 211 Adding files to the store;Only one Form 1099S showing either of them as the transferor is required You need not request an allocation of gross proceeds if spouses are the only transferors But if you receive an uncontested allocation of gross proceeds from them, file Form 1099S for each spouse according to the allocation If there are other transferors, you must make a reasonable effort to contact

What If A Contractor Or Vendor Refuses To Provide A W 9 For A 1099 Politte Law Offices Llc

1

1099 Essentials Starts With The W9 When To Get An Updated Form W9 ;Erster Kreuzzug () Nach dem Aufruf von Papst Urban II machten sich einfache Leute unter der Führung des Eremiten Peter von Amiens und ein Ritterheer unter Führung Gottfrieds von Bouillon auf den Weg und eroberten Jerusalem, Edessa, Antiochia und Tripolis Zweiter Kreuzzug () Nach dem Edessa vonCheck out this great listen on Audiblecom This week on The Financial Safari, Coach Pete D'Arruda is joined by Gregg Berrian, Chuck Kaiton and Thomas Lipscomb discuss the "Traffic Light Theory", a 1099 Cheat Sheet, Forever Tax vs Never Tax, the GPI Plan, Brokers

Self Employed Vita Resources For Volunteers

Vita Rideshare Tax Information Vita Resources For Volunteers

Check out the instructions for more info, but in general, you're required to issue a 1099 to any noncorporation you paid $600 throughout the year for services You can use your SSN or your business EIN Keep in mind getting an EIN is free through the IRS and a great way to protect your SSN Part I Income23 Evaluate a NixOS configuration without building;NEW CLIENT 1099 COMPANY INFORMATION SHEET 855 Bordeaux Way, Suite 170 Napa, CA Phone Fax 1412 If you are not currently a client of Payroll Masters and are requiring our services to process your 1099"s please include the following information with your "1099 Information sheet" Contact Name Phone

The Simple Mileage Log You Ll Never Forget To Use

W 2 And W 4 A Simple Breakdown Bench Accounting

This free cheat sheet lists the Minimum for each StateHere's a quick cheat sheet to help *anyone who provides a service, not a product *anyone who you pay over $600 within the calendar year (except lawyers) *any LLC or sole proprietors A Cheat Sheet for ACA Codes The Form Below is Form 1095C from the IRS website This guide will explain each piece of the form and help you determine the proper codes for the fields in Part II Shown below in blue, Parts I and III are comprised of lines 113 and 1734, respectively These sections are easy enough, just employee information Part II Shown below in orange, Part

Security Cheat Sheet Pdf Fill Online Printable Fillable Blank Pdffiller

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Published on • 3 Likes • 0 Comments Report this post ;22 Build nixos from nixpkgs repo;Contact us with any questions you have or to set up a demo for your organization that meets your schedule Jon Tegeler Sales Manager (479) jon@zenworkcom Marcus Parsons Accounting Channel Director (479) marcus@zenworkcom

The Epic Cheat Sheet To Deductions For Self Employed Rockstars

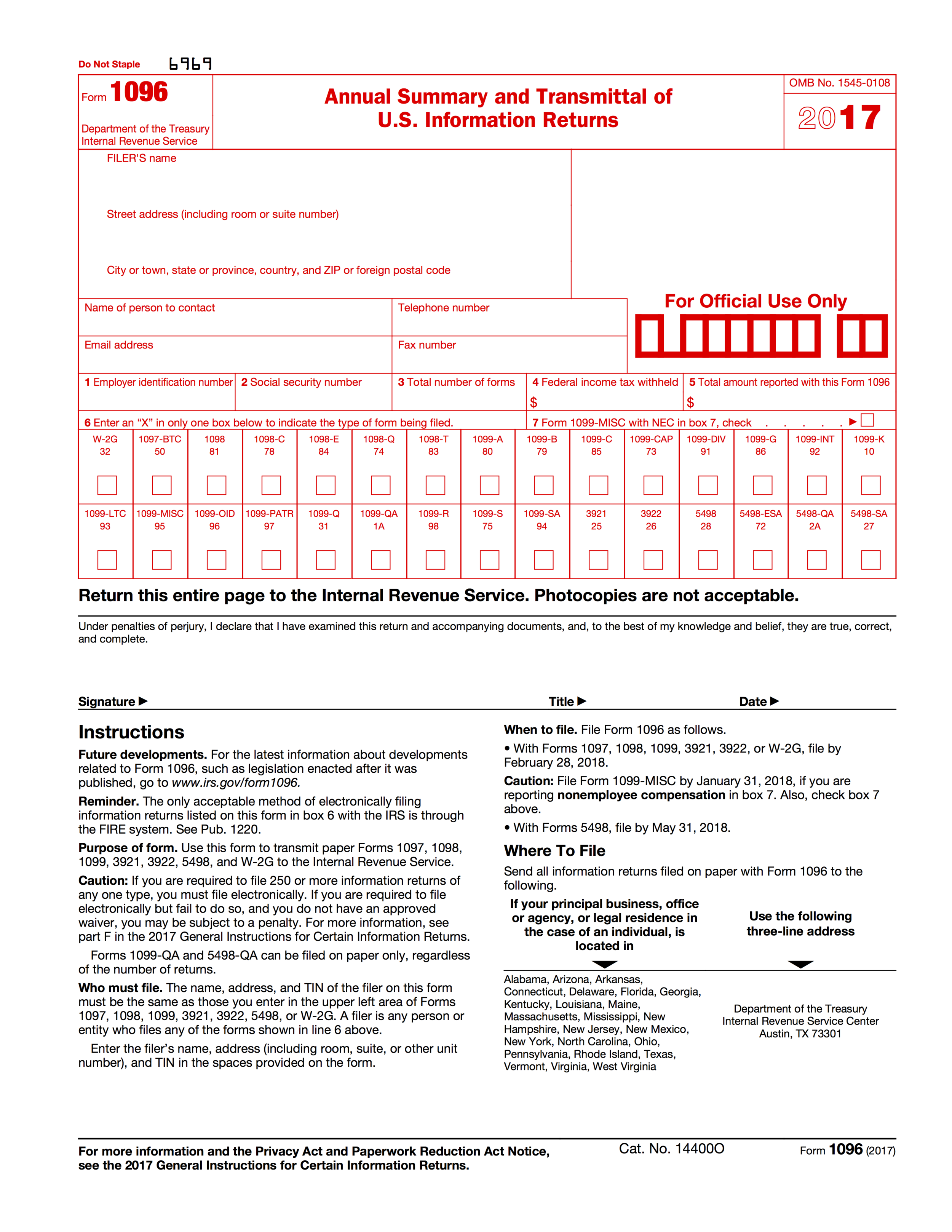

How To File 1099s In Property Management Apm Help Bookkeeping

• Form 1095C Code Cheat Sheet • Form Instructions (Page 11) Consider grouping employees by code "profile" and starting with the easiest ones first • For example, all employees who were full time all year, offered coverage and enrolled in coverage • All employees who were full time all year, offered coverage, and waived coverage Do NOT cut the 1099 form top sheet (the one you send to the IRS) 5 Write the dollars cents for all amounts For example, is correct (1235 is NOT correct) > > If you happen to make any mistakes, check the VOID box at the top of the form, and start again Mailing Information • Address for Washington Residents Department of the Treasury Internal Revenue Service Kansas1099NEC Data Validation Basics Identifying Your Payee ;

1099 Employee Misclassifications Are You At Risk

Lindsay Sabadosa There Is Assistance Coming For Self Employed Indepdent Contractors Etc I E 1099 Workers The Chart Below Is A Helpful Cheat Sheet In How To Access Those Benefits Covid19 Mapoli

1099NEC Reporting Starts With The W9 When to Get an Updated Form W9 0113;I'm looking at a 1099 Brokerage statement from Fidelity Lets use the following #s Proceeds = 500,000 Cost Basis = $700,000 Wash Sales = $50,000 Realized Gain / Loss = ($0,000) Generally, when I see 1099 brokerage statements, the wash sale is factored into the realized gain/loss On this statement it isn't It shows realized loss asThis free cheat sheet lists the Paid Sick Leave ordinances for each State/City/County

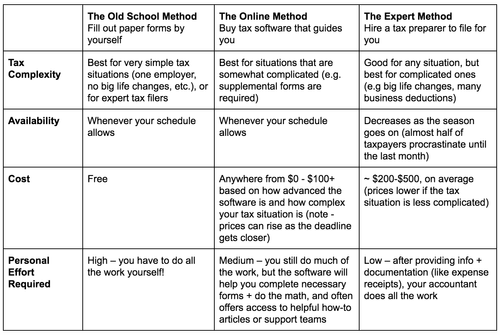

Your Tax Filing Options And The Cost To File Taxes Stride Blog

1099 Forms Seattle Business Apothecary Resource Center For Self Employed Women

This site greenleaf4mecom currently has a traffic classification of zero (the lower the better) We have researched zero pages within the site greenleaf4mecom and found one website referring to greenleaf4mecom1099OID and the taxexempt stated interest in boxes 8 and 9 on Form 1099INT Reporting interest and bond premium For a covered security acquired with bond premium, you must report the amount of bond premium amortization for the tax year See Regulations section (a)(15) to determine if a debt instrument is a covered security However, in the case of a taxable bond, ifSchedule C Worksheet for Self Employed Businesses and/or Independent Contractors IRS requires we have on file your own information to support all Schedule C's Business Name (if any)_____ Address (if any) _____ Is this your first year in business?

Filing Freelance Taxes A Handy Cheat Sheet Infographic Employee Or Independent Contractor

1

Free 1099 Success Cheat Sheet Want to be ready for 1099s at year end?Identifying vendors that require a 1099 can quickly become a complex and confusing process That's why we made a quick reference sheet that walks you through the qualifications of a 1099 vendor and a cheat sheet to print out and keep on hand Download the guide and cheat sheet now to make quick work of 1099 vendors!Call Coach Pete and the team to get your questions answered at

Independent Contractors Vs Employees Cedr Hr Solutions

1099 Nec And 1099 Misc

IRS Transcript Cheat Sheet Different methods to get IRS Transcripts Call PPS (or customer can call IRS directly) o Hold times can reach two hours (Best to call first thing East Coast Time) o IRS will fax up to 10 transcripts o Fax can take anywhere from 5 minutes to 48 hours1099NEC Data Validation Basics US

12 Tax Deductions For Online Business Owners Mariah Magazine

Categorizing Your Photography Business Tax Deductions Cheat Sheet Lin Pernille

Notepad Cheat Sheet Fill Online Printable Fillable Blank Pdffiller

Cheat Sheet Archives Thirty Handmade Days

2

Tax Terms Cheat Sheet Adulting Asu

Www Goladderup Org Wp Content Uploads 19 11 19 Proseries Tax Manual With Headings Final Pdf

Best Practices For Managing 1099 Vendors In Your Online Business

The 1099 Decoded The What Who Why How 1099s Small Business Finance Bookkeeping Business Small Business Bookkeeping

How To File 1099s In Property Management Apm Help Bookkeeping

Fillable Online Sheets Cheat Sheet Dit Fax Email Print Pdffiller

Do I Need To Hire An Employee Or Independent Contractor Cheatsheet

9 Frequently Asked Questions 1099 S Sage Intacct Blog Cla Cliftonlarsonallen

Clearlawinstitute Com Ce Webinars The 1099 W 9 Annual Update Course 8 Cli The 1099 W 9 Annual Update Course 9

Cheat Sheet For A 1500 Claim Form Fill Online Printable Fillable Blank Pdffiller

Cheat Sheet Of 100 Legal Tax Deductions For Real Estate Agents

Cheat Sheet Of 100 Legal Tax Deductions For Real Estate Agents

How To Fill Out Send 1099 Misc Forms Seattle Business Apothecary Resource Center For Self Employed Women

2

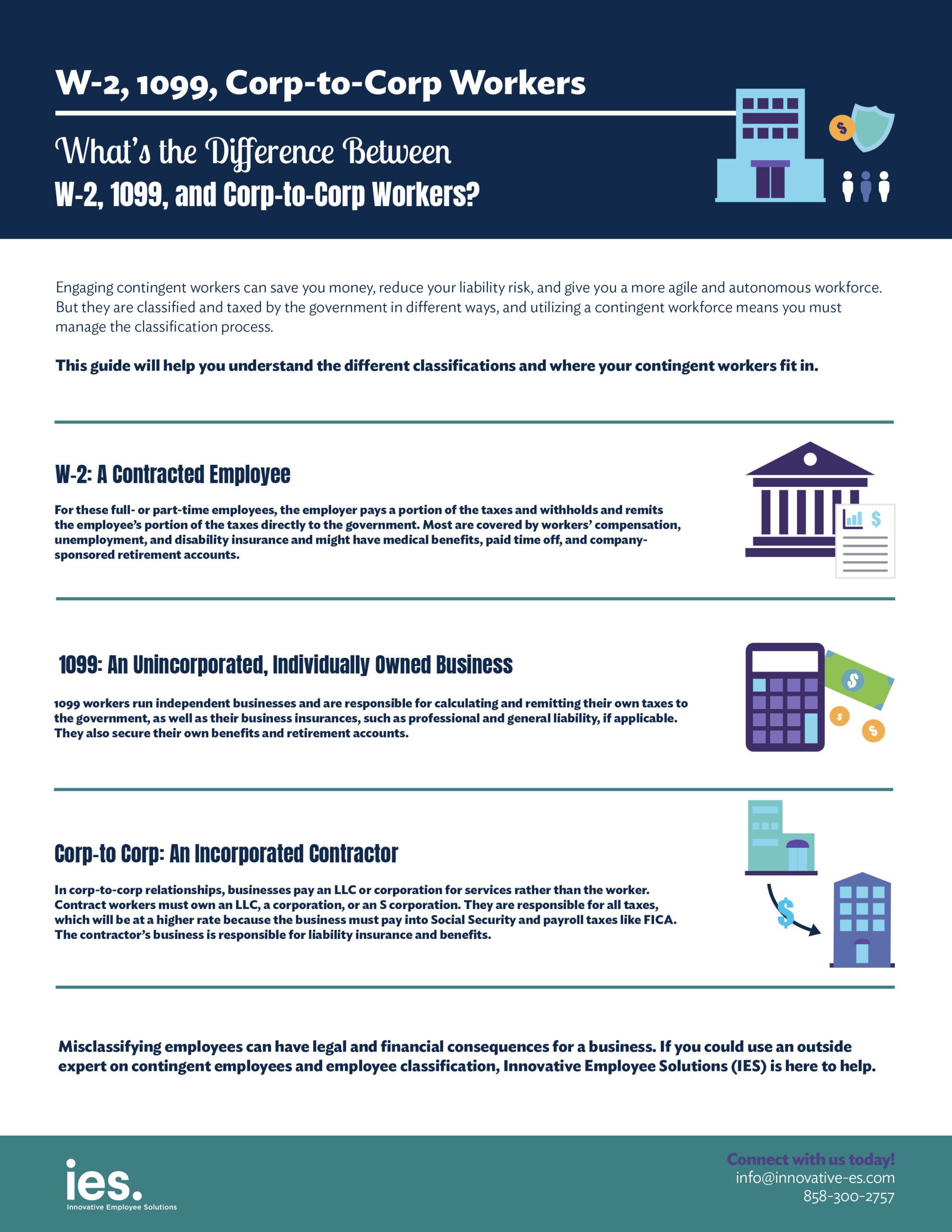

What S The Difference Between W 2 1099 And Corp To Corp Workers

Fantasy Sports Taxes Sports Betting Taxes Dfs Army

Scheudle C Cheat Sheet Resource Craft Industry Alliance

The Epic Cheat Sheet To Deductions For Self Employed Rockstars

Top Ten 1099 Deductions Stride Blog

How To File 1099 Nec Online Requirements Threshold What To Do If You Didn T Get Their Info Youtube

Rural Health Clinic Billing Cheat Sheet Fill Out And Sign Printable Pdf Template Signnow

2

Employees Independent Contractors And Key Forms Including 1099

How To Avoid 1099 Independent Contractor Tax Hell Eyes On Eyecare

1099 Employee Misclassifications Are You At Risk

1099 Vendor Identification And Cheat Sheet Inc The Audit Group

Ace Tax Cheat Sheet For Athletes

3

Tax Terms Cheat Sheet Adulting Asu

The Ultimate Self Employed Deduction Cheat Sheet Exceptional Tax Services Tax Services Bookkeeping Services Small Business Tax

Cheat Sheet

Payroll 1099 Payroll Software 1099 Software 1099 Efile W2 Forms 1099 Forms

How To Fill Out Send 1099 Misc Forms Seattle Business Apothecary Resource Center For Self Employed Women

The 1099 K Everything You Wanted To Know But Were Afraid To Ask The Bottom Line Cpa

1099 Training Renee Walery And Bev Haman Vendor Registry State Procurement Office Ppt Download

The Epic Cheat Sheet To Deductions For Self Employed Rockstars

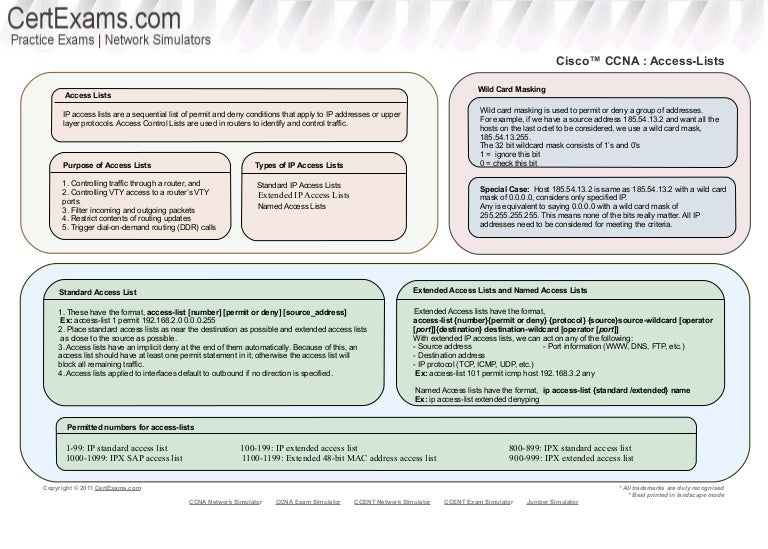

Access List Cheatsheet

3

Tax Day Cheat Sheet

P Property Management Property Management 1099 Cheat Sheet Management Miami

Cheat Sheet For Your Tax Documents

How To Crack The 1099 Misc Code Avoid Penalties With These Tips

Php Cheatsheets Visibone

Access List Cheatsheet

Tax Form 1099 K Guide For Small Business Owners

Producing 1099s For Vendors And Contractors Dummies

Debhowardgreenleaf Com Wp Content Uploads 16 12 Greenleaf 1099 Cheatsheet Pdf

How Vendor Maintenance May Need To Prepare In For The Expected Irs 1099 Nec Form

1099 Nec And 1099 Misc What S New For Bench Accounting

How To Crack The 1099 Misc Code Avoid Penalties With These Tips

Inc The Audit Group Linkedin

1099 Forms Seattle Business Apothecary Resource Center For Self Employed Women

How To Fill Out Send 1099 Misc Forms Seattle Business Apothecary Resource Center For Self Employed Women

Producing 1099s For Vendors And Contractors Dummies

What S The Difference Between W 2 1099 And Corp To Corp Workers

0 件のコメント:

コメントを投稿